Table of Contents

ToggleLoan Origination Systems rarely collapse overnight.

In fact, most of them perform reasonably well during initial rollout. The workflows function, applications get processed, approvals happen, and stakeholders feel confident about the investment. This early success often creates a false sense of security. The system appears stable, reliable, and “future-ready.”

But then change arrives.

It could be a new regulatory mandate, a sudden surge in loan applications, a shift in customer expectations, or the launch of a new lending product. That is when the cracks begin to show. And when they do, institutions realize that the problem was never about features or user interfaces, it was about how the system was engineered at its core.

The Illusion of Stability in Traditional Loan Origination Systems

Most LOS platforms are designed to solve a well-defined problem at a specific point in time. They are built around known regulations, current lending products, and predictable volumes. In controlled conditions, this approach works. However, financial services rarely operate in controlled conditions for long.

As lending ecosystems grow more complex, institutions must deal with:

-

Frequent regulatory updates

-

Increased scrutiny on risk and compliance

-

Integration with external fintech platforms

-

Rapid digital adoption by customers

Despite this reality, many LOS platforms continue to be designed as static systems. They assume stability where none exists. This mismatch between system design and business reality is where long-term failure begins.

We have worked closely with financial institutions across different markets, and often saw the same pattern repeat itself: systems optimized for the present struggle to survive the future.

Architecture Built for the Present Is the Core Problem

At the heart of most LOS failures lies a fundamental architectural flaw: the system was never designed to evolve.

When architecture decisions prioritize immediate requirements over long-term adaptability, institutions inherit hidden risks. These risks remain dormant until the first major change event occurs. At that point, even minor updates can trigger cascading issues across the system.

Change in lending is not an exception, it is the rule. Regulatory frameworks evolve, customer behavior shifts, and competitive pressure forces institutions to innovate continuously. A Loan Origination System that cannot accommodate this reality becomes a bottleneck rather than a growth enabler.

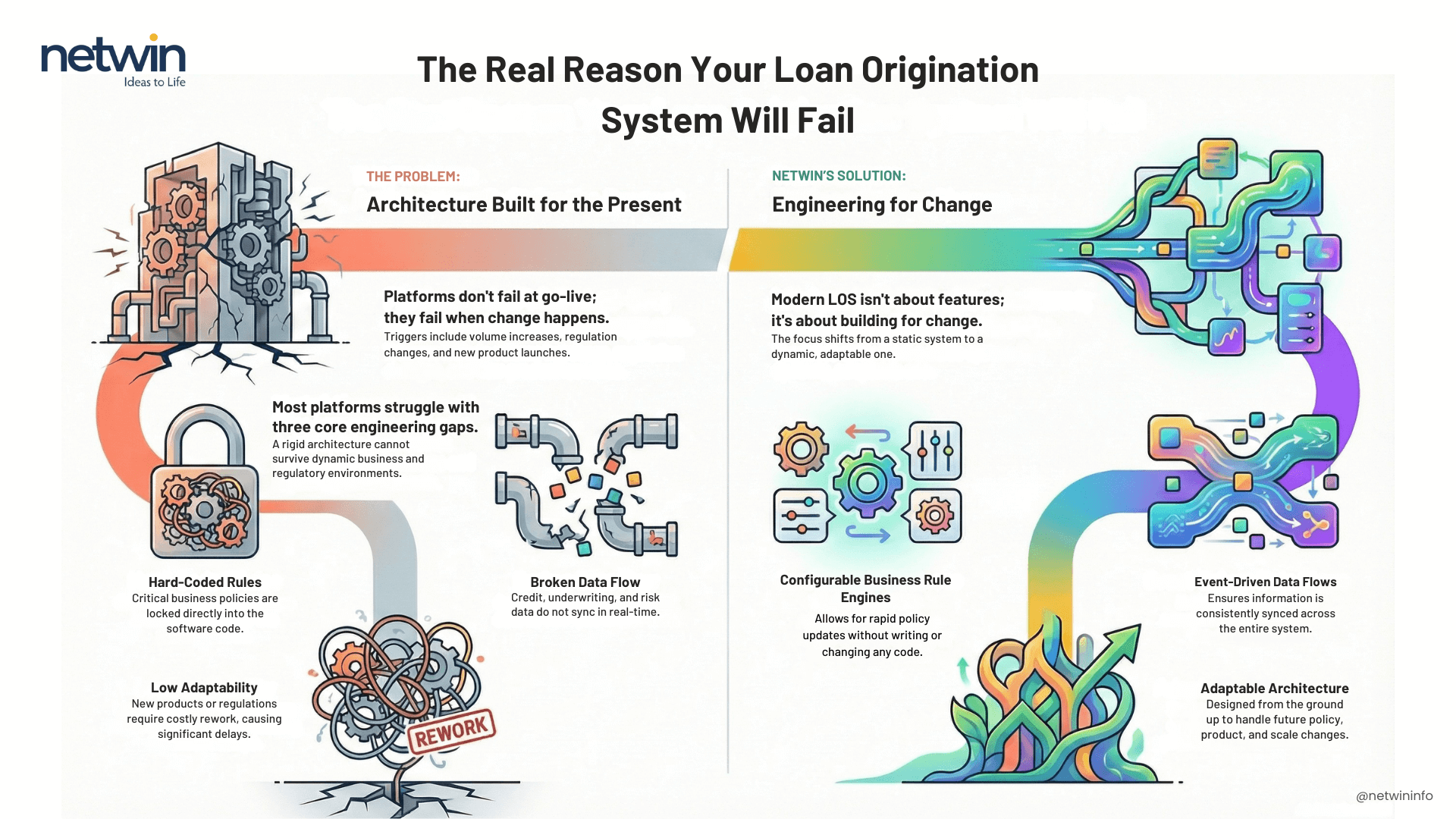

The Three Engineering Gaps That Cause LOS Failure

The infographic identifies three recurring engineering gaps that consistently undermine Loan Origination Systems. These gaps are not theoretical; they are practical, structural issues observed across legacy and mid-generation platforms.

1. Hard-Coded Business Rules:

Hard-coded business rules are one of the most damaging design decisions in an LOS. In such systems, critical lending logic, credit policies, eligibility checks, approval thresholds, and exception handling is embedded directly into the application code.

At first, this approach appears efficient. It ensures strict control and predictable behavior. However, the moment a policy change is required, the system becomes rigid.

Every update demands:

-

Code changes

-

Developer intervention

-

Regression testing

-

Deployment cycles

This significantly slows down response times, especially in regulatory-driven environments where speed and accuracy are non-negotiable.

Over time, institutions begin to avoid making changes altogether because of the operational risk involved. This leads to outdated policies, manual workarounds, and increased compliance exposure.

Netwin’s experience across multiple digital transformation programs highlights that business rules should never be locked inside code. Flexibility must be a foundational principle, not a future enhancement.

2. Broken Data Flow:

A modern Loan Origination System is deeply interconnected. It relies on real-time inputs from multiple internal and external systems, including credit bureaus, underwriting engines, core banking platforms, fraud detection tools, and CRMs.

Yet many LOS platforms still operate on fragmented or batch-based data flows.

This creates a dangerous gap between reality and decision-making.

When data does not flow seamlessly:

-

Credit scores may be outdated

-

Risk assessments may be incomplete

-

Approval decisions may be inconsistent

-

Customer experiences may feel disjointed

From a business perspective, this is not merely a technical inefficiency. It directly impacts risk quality, operational confidence, and regulatory compliance. Institutions may approve loans they should not, or reject customers they should not lose.

Netwin’s system modernization work repeatedly reinforces one insight: real-time data flow is not optional for scalable lending operations.

3. Low Adaptability:

Low adaptability is perhaps the most expensive problem of all, even though it often remains invisible at first.

When an LOS lacks adaptability, every new requirement, be it a regulatory change, product launch, or market expansion, results in rework. Over time, this rework compounds, increasing system complexity and reducing reliability.

Institutions may find themselves:

-

Delaying product launches

-

Running parallel manual processes

-

Increasing dependency on IT teams

-

Accumulating technical debt

Eventually, the LOS becomes so fragile that even small changes feel risky. At this stage, institutions often face a difficult decision: continue patching the system or replace it entirely.

The infographic captures this reality visually with tangled workflows and repeated “rework” cycles—a scenario many financial organizations know all too well.

Why Modern LOS Thinking Has Shifted

One of the most important messages in the infographic is that modern Loan Origination Systems are not defined by features.

They are defined by their ability to adapt.

In the past, LOS evaluations focused heavily on checklists, number of workflows supported, types of loans handled, or integration options available. While these factors still matter, they are no longer sufficient.

What truly differentiates a modern LOS is how it responds to uncertainty.

Netwin’s approach to engineering financial systems reflects this shift, prioritizing architectural resilience over short-term completeness.

Engineering for Change: A Different Way of Building LOS Platforms

The right side of the infographic outlines what it means to engineer a Loan Origination System for change. This is not about adding layers of complexity, it is about designing systems that remain stable even as everything around them evolves.

Configurable Business Rule Engines

Configurable rule engines separate business logic from system logic. This allows institutions to update policies, thresholds, and workflows without touching the underlying code.

The impact of this approach is significant:

-

Faster regulatory compliance

-

Reduced operational risk

-

Greater autonomy for business teams

-

Shorter time-to-market for new products

Instead of fearing change, institutions gain confidence in managing it.

This design philosophy is increasingly central to how Netwin approaches enterprise-grade LOS engineering.

Event-Driven Data Flows for Real-Time Responsiveness

Event-driven architecture ensures that systems respond instantly to changes rather than waiting for scheduled updates.

In an event-driven LOS:

-

Data updates propagate immediately

-

Decisions are based on current information

-

Systems remain loosely coupled but highly responsive

This is especially critical in high-volume lending environments, where delays of even a few minutes can create operational bottlenecks.

The infographic’s emphasis on event-driven data flows reflects a growing industry consensus: real-time responsiveness is foundational, not advanced.

Adaptable Architecture Built for Long-Term Evolution

Adaptable architecture is about designing systems that grow without breaking.

This includes:

-

Modular components

-

API-first integration

-

Scalable infrastructure

-

Clear separation of concerns

Rather than rebuilding systems every few years, institutions can evolve them incrementally, preserving stability while enabling innovation.

Netwin’s long-term work in digital transformation consistently underscores the value of architectures that support continuous change rather than periodic disruption.

Why LOS Failure Is a Strategic Risk, Not Just a Technical Issue?

When a Loan Origination System fails, the consequences extend far beyond IT teams.

System rigidity directly affects:

-

Revenue growth

-

Customer satisfaction

-

Compliance posture

-

Organizational agility

In competitive lending markets, slow adaptation translates into lost opportunities and weakened trust.

That is why LOS decisions should be treated as strategic business decisions, not just technology procurements.

The Questions Every Financial Institution Should Ask

Before selecting or modernizing an LOS, institutions should pause and reflect:

- Can we adapt quickly when regulations change?

- Can our system handle unexpected growth?

- Are business rules configurable without development cycles?

- Is our data truly real-time across systems?

- Will this platform still serve us five years from now?

These questions reveal more about future readiness than any feature list ever could.

Final Thoughts:

The Future Belongs to Change-Ready Systems.

The real reason your Loan Origination System will fail is not poor implementation or vendor limitations.

It will fail if it cannot change.

Rigid systems break under pressure. Adaptable systems absorb change and turn it into advantage.

As the lending landscape continues to evolve, institutions that invest in engineering for change will not only avoid failure, they will unlock sustainable growth.

Netwin’s perspective, shaped by years of working with complex financial systems, reinforces one enduring principle: systems designed to evolve are the ones that endure.